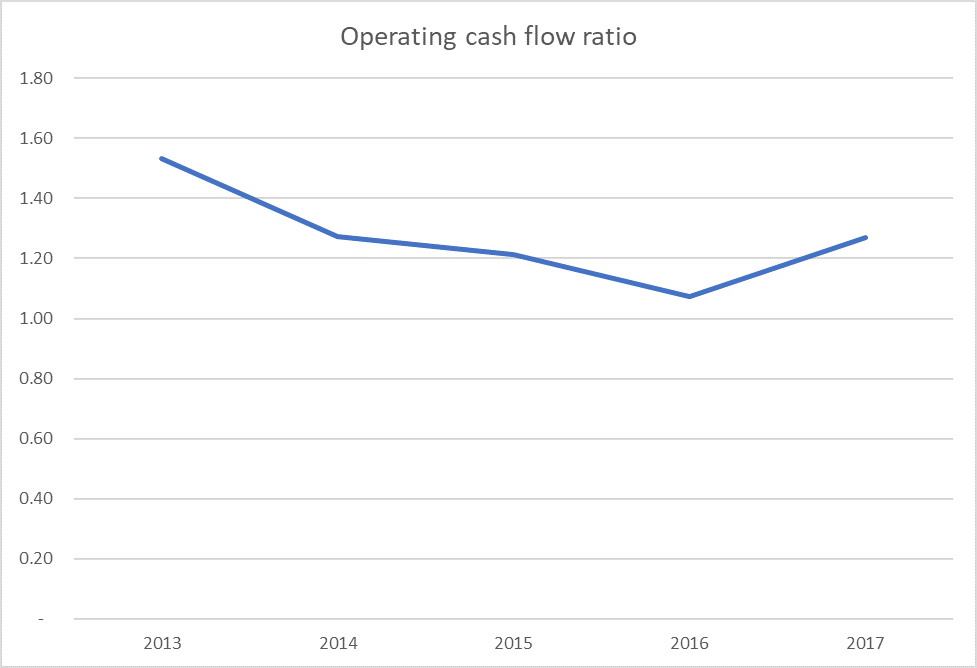

operating cash flow ratio industry average

Operating cash flow ratio is an important measure of a companys liquidity ie. No index reports after tax results.

Operating Cash Flow Ratio Definition Formula Example

This resource is only available to current UTSA faculty students and staff.

. It reveals a companys ability to meet its. On the trailing twelve months basis Current Liabilities decreased faster than Oil And Gas Production Industrys Cash cash equivalent this led to improvement in Oil And Gas Production Industrys Quick Ratio to 036 in the 4 Q 2021 Quick Ratio remained below Oil And Gas Production Industry average. On the trailing twelve months basis.

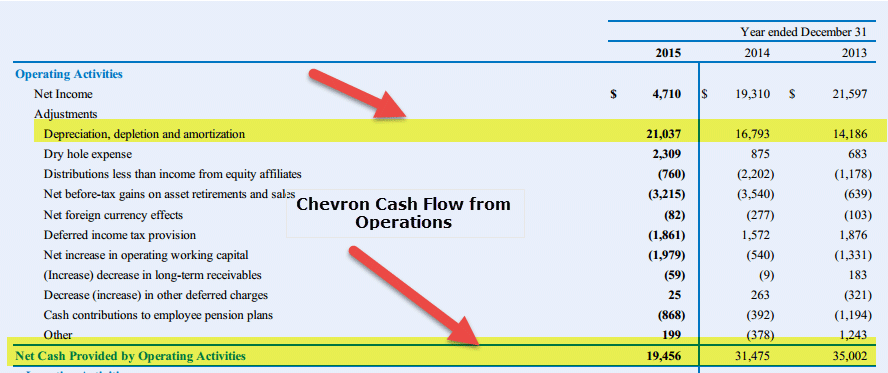

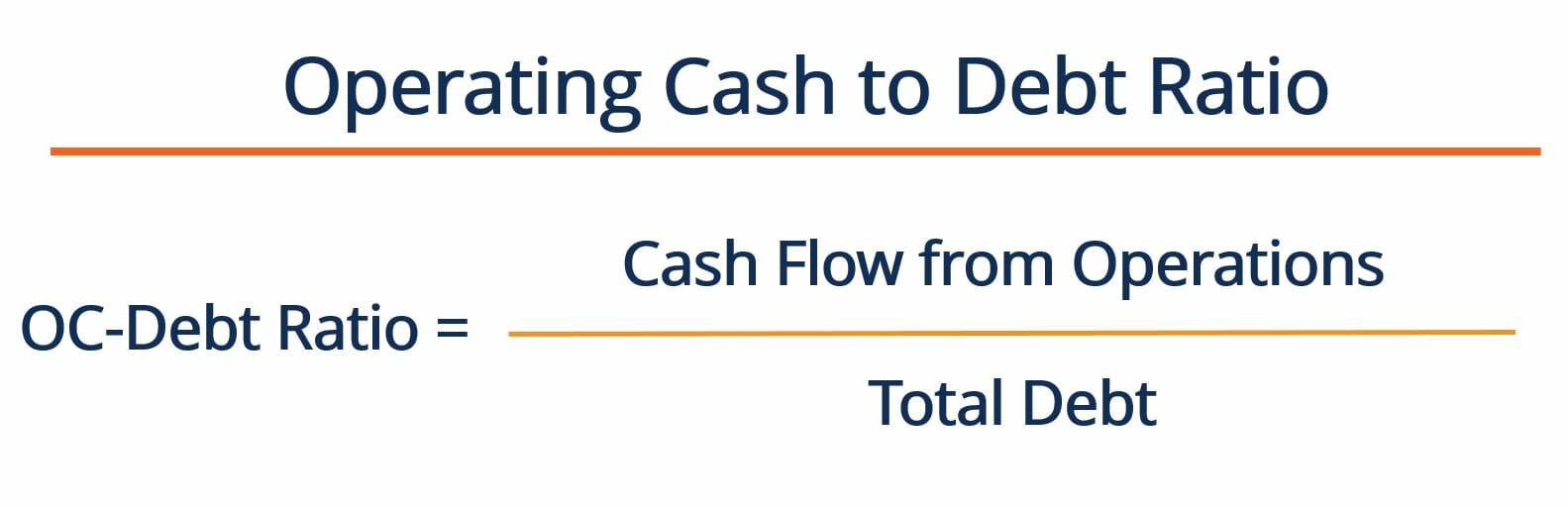

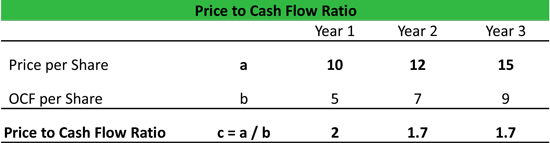

Targets operating cash flow ratio works out to. The Operating Cash to Debt Ratio measures the percentage of a companys total debt that is covered by its operating cash flow for a given accounting period. In 2014 Times Interest Earned was.

Operating cash flow ratio determines the number of times the current liabilities can be paid off out of net operating cash flow. Operating and Financial Ratios. This compares to 14 for those industries with the largest cash balances at 20-40 of sales.

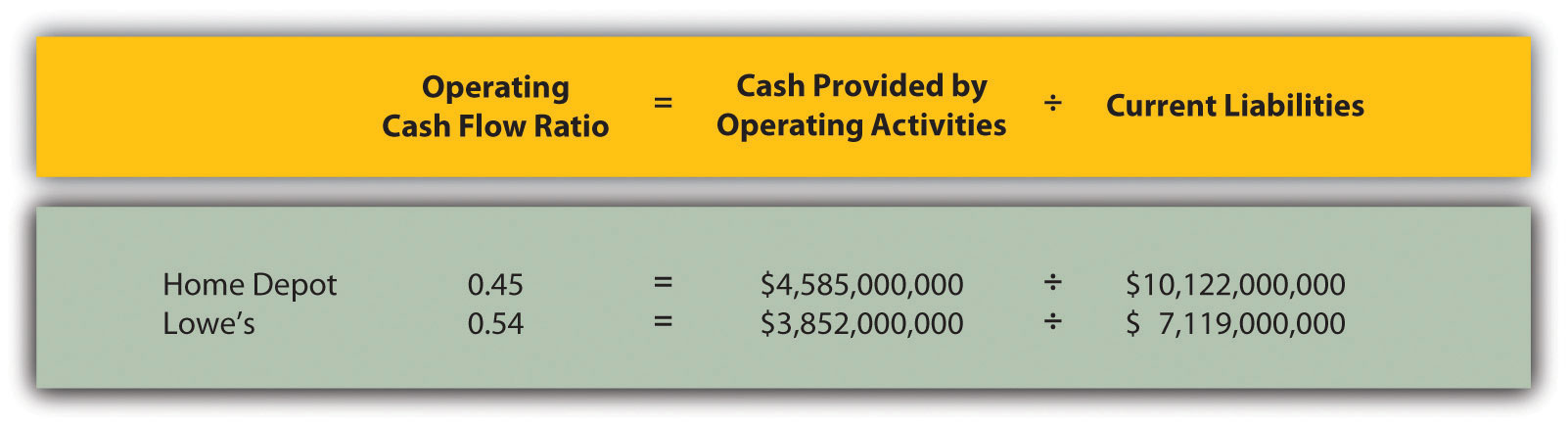

The operating cash flow ratio for Walmart is 036 or 278 billion divided by 775 billion. This ratio is generally accepted as being more reliable than the priceearnings ratio as it is harder for false internal adjustments to be made. Free Cash Flow growth total ranking has deteriorated compare to.

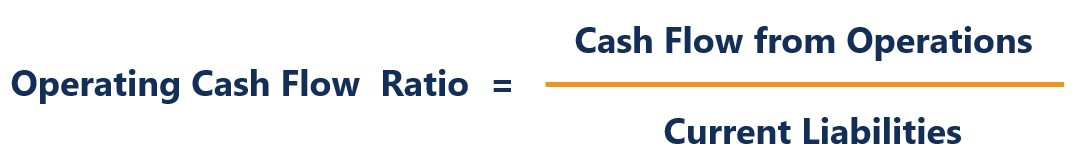

Other Ratios 69-72 70. Operating Cash Flow Ratio Operating Cash Flow Current Liabilities. WRDS Research Team.

It measures the amount of operating cash flow generated per share of stock. The price-to-cash flow ratio is a valuation ratio useful when a business is publicly traded. A higher ratio is better.

The operating cash flow ratio is not the same as the operating cash flow margin or the net income margin which includes transactions that did not involve actual transfers of money depreciation is common example. Personal Cash Flow Business OwnerGuarantor Salary Business Income 500M Rental Income etc. The formula for calculating the operating cash flow ratio is as follows.

75 rows Cash Ratio - breakdown by industry. In the first liquidity indicators the most useful ratios are operating cash flow OCF funds flow coverage FFC cash interest coverage CIC and cash debt coverage CDC. The operating cash flow refers to the cash that a company generates through its core operating activities.

Pretret_noa Profitability Operating Income After Depreciation as a fraction of average Net Operating Assets NOA based on most. No other fund even came close. Thats the NASDAQ 100 at 3641.

Within Healthcare sector Major Pharmaceutical Preparations Industry achieved highest Free Cash Flow growth. Total Income Less. Meaning the interest of The Learning Company was covered 9 times.

Operating Cash Ratio Formula and Understanding Value Investment Funds Two 14 Year Running Average Annual Return After Quarterly Taxes 28 2615 Only one major index beat this Funds average annual return. It should be considered together with other liquidity ratios such as current ratio. Federal State Taxes 150M Cash Flow Available 350M For Debt Service Less.

Cash ratio is a refinement of quick ratio and. Operating cash flow ratio is generally calculated using the following formula. Cash flow from operations can be found on a companys statement of cash flows Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period.

Operating CFCurrent Liabilities. 18000 2000 9. Indeed the ten sub-sectors with the lowest cash at 5-8 of sales commanded an operating margin averaging just 6.

Most commercial underwriters want to see a minimum guarantor DCR of 100X to 140X. Price Earnings Price Book Net Profit Margin Price to Free Cash Flow Return on Equity Total Debt Equity and Dividend Yield. In the second category ratios used to assess a companys strength on an ongoing basis we like total free cash TFC cash flow adequacy CFA cash to capital.

Within Energy sector 3 other industries have achieved. Financial Soundness 36-51 39. Alternatively the formula for cash flow from operations is.

Free Cash FlowOperating Cash Flow. Its ability to pay off short-term financial obligations. Many trade associations and other specialized organizations also publish financial ratios and ratios sometimes appear in newspapers and journal articles.

WRDS Industry Financial Ratio WIFR hereafter is a collection of most commonly used financial. This ratio is calculated by dividing operating cash flow a figure that can be obtained from a companys cash flow statement by total debt obligations. Price-to-Operating-Cash-Flow Ratio Share Price Cash Flow from Operations per share TTM 2330 22 1059.

Operating Income also known as Operating Income Before Interest Expense and Taxes divided by Interest Expense Times Interest Earned Ratio. 220 rows Operating cash flow ratio Operating cash flow Current liabilities. Free Cash FlowOperating Cash Flow.

For a book about business ratios UCLA users can see Steven MBraggs Business Ratios and Formulas. Major Pharmaceutical Preparations Industrys pace of Free Cash Flow growth in 4 Q 2021 decelerated to 2729 year on year but remained above Industry average. Domicile also seems to have some bearing on the level of cash held.

But that was with pre-tax results. The Times Interest Earned Ratio is. Debt Service PI 200M Margin 150M DCR 175X Note.

This usually represents the biggest stream of cash that a company generates. Yahoos Industry Statistics ratios include. WRDS Industry Financial Ratio.

Financial Ratios Industry Level in WRDS Financial Ratios Industry Level by WRDS Beta Please note.

How Is The Statement Of Cash Flows Prepared And Used

Price To Cash Flow Ratio Formula Example Calculation Analysis

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Cash Flow Per Share Formula Example How To Calculate

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Price To Cash Flow Formula Example Calculate P Cf Ratio

Operating Cash Flow Ratio Formula Guide For Financial Analysts